TRANSFORMATIONAL INVESTMENT TRACK RECORD

Multiples and IRRs

Since 1987, JAPONICA PARTNERS has built our track record by creating transformational investments with low risk high return.

Japonica Partners track record and culture are built on seeing what others do not see and using “education-education-education” to accomplish what others believe is impossible.

Japonica Partners compares its three investment performance metrics against a Top 10 PE Index. Since inception through fiscal year-end 2020, the performance metrics (PDF) are:

| TVPI | DPI | IRR | |

|---|---|---|---|

| Japonica Partners | 6.05x | 6.05x | 89% |

| Top 10 PE Index | 1.59x | 1.59x | 13% |

| Japonica Partners vs Top 10 PE Index | 3.80x | 3.82x | 76 pp |

The Top 10 PE Index sponsors are Advent, Apollo, Blackstone, Carlyle, Cerberus, CVC, KKR, Silver Lake, TPG and Warburg Pincus. Top 10 PE Index data is primary sourced from 259 LP interests in 191 sponsor funds with $80 billion distributed.

Japonica believes that its track record of low risk high return investments have benefited from “perfectly aligned” co-investor relationships that do not rely on debt to increase returns, do not have annual management fees, and do not have transactions fees, but after exceeding high ROI benchmarks do have an equal 50/50 profit sharing.

Investment performance metrics are based on Global Investment Performance Standards (GIPS), with individual transformational investments reported gross, and combined reported net of fees and expenses.

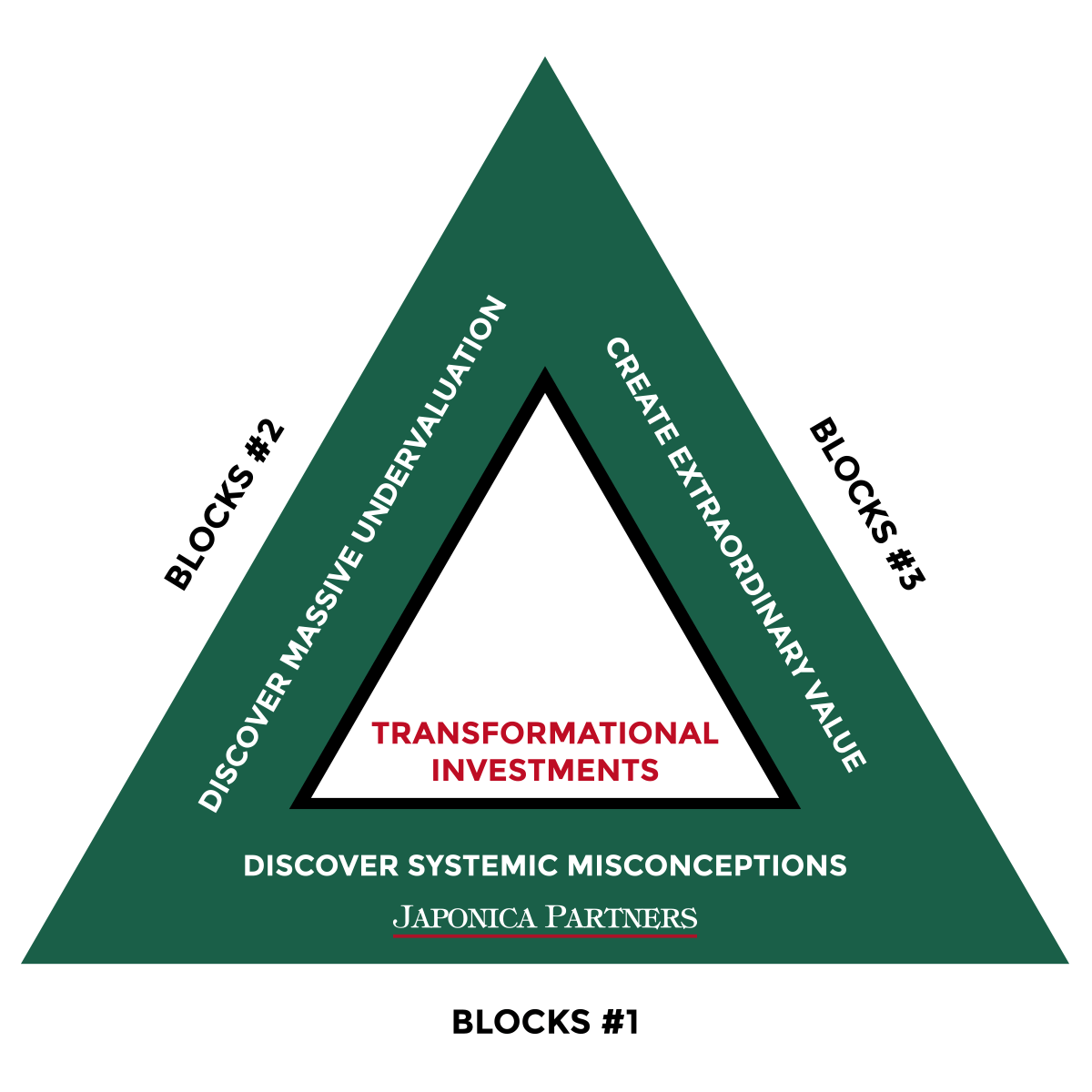

Japonica’s transformational investments have three building blocks: discover systemic misconceptions, discover a massive undervaluation, and create extraordinary value. Japonica is not a fund and does not provide investment advice.